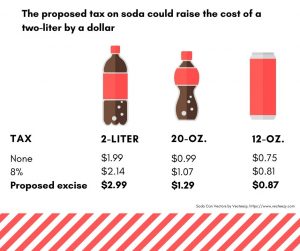

As the D.C. Council considers a new soda tax that could drive the price of a two-liter bottle of Coke up $1, the people the legislation is designed to help are balking against it.

The council quietly increased the sales tax on soda and sugary drinks from 6% to 8% in early October. But now the proposed Healthy Beverages Act of 2019 would replace it with a 1.5-cent-per-ounce excise tax on the beverages. Councilmembers say the measure will help fund public health programs for low-income residents.

But neighborhoods in Ward 8 are already feeling the effects of the first tax hike.

“They shouldn’t be taxing us,” said Ezra Calloway Sr., 67, as he left New 7 Market on New Hope Road SE. with a soda. “People are struggling to survive as it is. I don’t have money to come around here, and everything I buy they want to tax.”

With the current 8% sales tax, a 99-cent, 20-ounce bottle of soda costs customers $1.07. The proposed excise tax would change the sticker price on that item to $1.29.

The legislation would help the city fund programs to help communities affected the most by sugary drinks and a lack of access to healthy food – like the city’s “Birth-to-Three” Act and the Department of Health’s Produce Rx program – according to the bill’s sponsor, Ward 1 Councilmember Brianne K. Nadeau.

“In D.C., residents living in the lowest income neighborhoods have the least access to healthy drinks and full-service grocery options,” Nadeau said in a statement. “This bill reinvests in our neighborhoods by providing healthy food, expanding childcare options and improving parks.”

Elmo Davis, 44, who bought snacks from a convenience store in Anacostia on a recent Tuesday, suggested the city find other sources of revenue for public health services.

“I mean, they got other funds they can get money from besides taxing soda,” Davis said. “I might think twice before buying [a soda.]”

Helen Park owns the New 7 Market in Anacostia and said customers have been frustrated since the city hiked the sales tax on soda. She doesn’t expect the situation to improve if the council continues to drive prices through an excise tax.

“They’re angry. That’s a problem,” Park said.

She added, she doesn’t think the measure will discourage people from drinking sugary sodas, sports drinks, juices or iced teas.

“People will drink whatever they want to drink,” Park said.

An excise tax is imposed on distributors, who pass the cost onto consumers. That means the price tag on soda and sugary drinks would increase.

Seven U.S. cities now have excise taxes on sugary drinks, including Philadelphia and San Francisco, said Richard Auxier, a research associate in the Urban-Brookings Tax Policy Center at the Urban Institute. It’s difficult to determine if the taxes have accomplished what lawmakers wanted, he said.

Research at Northwestern University showed an excise tax of 1.5 cents per ounce led to 46% fewer soda and sugary drink sales in Philadelphia. But there was a sharp increase in soda sales outside the cities’ limits.

“Basically, it seems that a lot of people in Philadelphia are driving to stores right outside the city to buy their beverages,” Auxier said. “When you take that into account, sales in and around the city dropped about 20%, not 46%.”

People will drink whatever they want to drink.

In the District, proponents say the tax would help curb health disparities. Research has linked sugary drink consumption to heart disease and diabetes.

About half of all adults living in the District have diabetes or prediabetes, according to the American Diabetes Association. In 2016, 15% of adults living in Wards 7 and 8 had diabetes, a rate four times higher than Ward 3, D.C. Department of Health Data shows.

And, research from the Center for Science in the Public Interest, says the beverage industry targets communities of color. Black children are twice as likely to see TV ads for sugary drinks than white kids.

Auxier warned the tax may not be a stable source of revenue for the city. But, it could be too soon to tell.

“Is it a good source of revenue? No, in a sense that it’s going to be volatile. It’s a little unpredictable,” Auxier said. “You wouldn’t want to make a very important service depend on this revenue.”

He estimates the tax would raise funds “in the millions, not in the hundreds of millions.”

Anacostia is one of the poorest neighborhoods in D.C. While the soda tax is designed to help the area’s residents, some view it as a punishment.

“People don’t like it. They say, ‘We are poor, we don’t have money,’” said Fikre Aytenfisn, the manager at Anacostia Beer and Wine. “They expect everything to be a dollar because it has [a 99-cent sticker] on it.”

Ward 8 Councilmember Trayon White is a vocal supporter of the Healthy Beverages Act of 2019. His office did not respond to a request for comment from the Wash.

“It’s a poor area out here,” Aytenfisn said. “Most of them, they don’t want to pay.”

Add comment