This year, Americans spent a record $9.6 billion on Black Friday sales, with a 7.5% increase from last year, according to Adobe Data. But the question is, how do they manage their finances after they have drained their wallets?

Digital Media Manager Stephanie Stratos said she rarely has time to shop in person because her workdays are long. The only shopping place that offers returns with no repackaging is Amazon. That is where most of her credit card bills pile up.

“I don’t think about paying it off. I’m being totally honest here. I do overthink how much I have spent and then think of drastic ways to get more money to pay it off,” said Stratos.

Even though inflation and interest rates have forced some people to live on tighter budgets and Americans have voiced concerns about the state of the economy, 200 million shoppers were out spending on Black Friday, according to the National Retail Federation.

Patrick Hannah, an Assistant Manager of a bakery chain store, said he doesn’t stress over money. He buys Christmas gifts for his family members on Black Friday, and some gifts may not be on sale.

“Managing money is the same for me throughout the entire year. After I pay my bills, I’ll only leave a certain amount in my checking and the rest goes to savings or investing”, said Hannah.

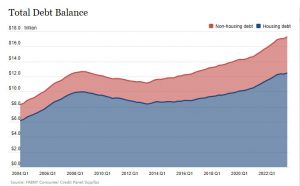

According to the latest consumer debt data from the Federal Reserve Bank of New York, Americans’ total credit card balance is $17.29 trillion in the third quarter of 2023. Delinquency transition rates increased for most debt types except for student loans.

According to the latest consumer debt data from the Federal Reserve Bank of New York, Americans’ total credit card balance is $17.29 trillion in the third quarter of 2023. Delinquency transition rates increased for most debt types except for student loans.

Janae Bowen, a TV station journalist in D.C., was not among the Black Friday shoppers as she and her husband want to climb out of their credit card debt and other debts.

“We have a toddler, and I have student loan debt, so we’re not really big on spending a lot right now,” said Bowen.

The Bowens are trying to live on a budget and save money. They shared how they are doing so with The Wash.

“We consolidated some of our debt not too long ago and we have a little bit of, I guess you could say, like, a safety fund, and that’s just from a personal loan that we have,” said the Bowens.

The Federal Trade Commission advises consumers on ways to get out of debt. The recommendation from FTC is to list all the monthly expenses, add up all paychecks, and subtract the total monthly cost from the total income. This worksheet will help consumers to determine where to make cuts and save money.

Quincy Lee Noche, a tech at United Airlines, said he took some of that FTC advice and is now enjoying a more secure financial life with his wife and two daughters. He said he is not big on Black Fridays but loves taking vacations abroad.

“I use my credit card but pay it off quickly. I have it all planned out and know how much I am going to spend,” said Lee Noche.

Lee Noche said he is fortunate to have a lifestyle to take multiple vacations each year and work to pay off any debt that accumulates.

“My mind is, you don’t have to be rich. You have to live smart,” said Noche.

Add comment